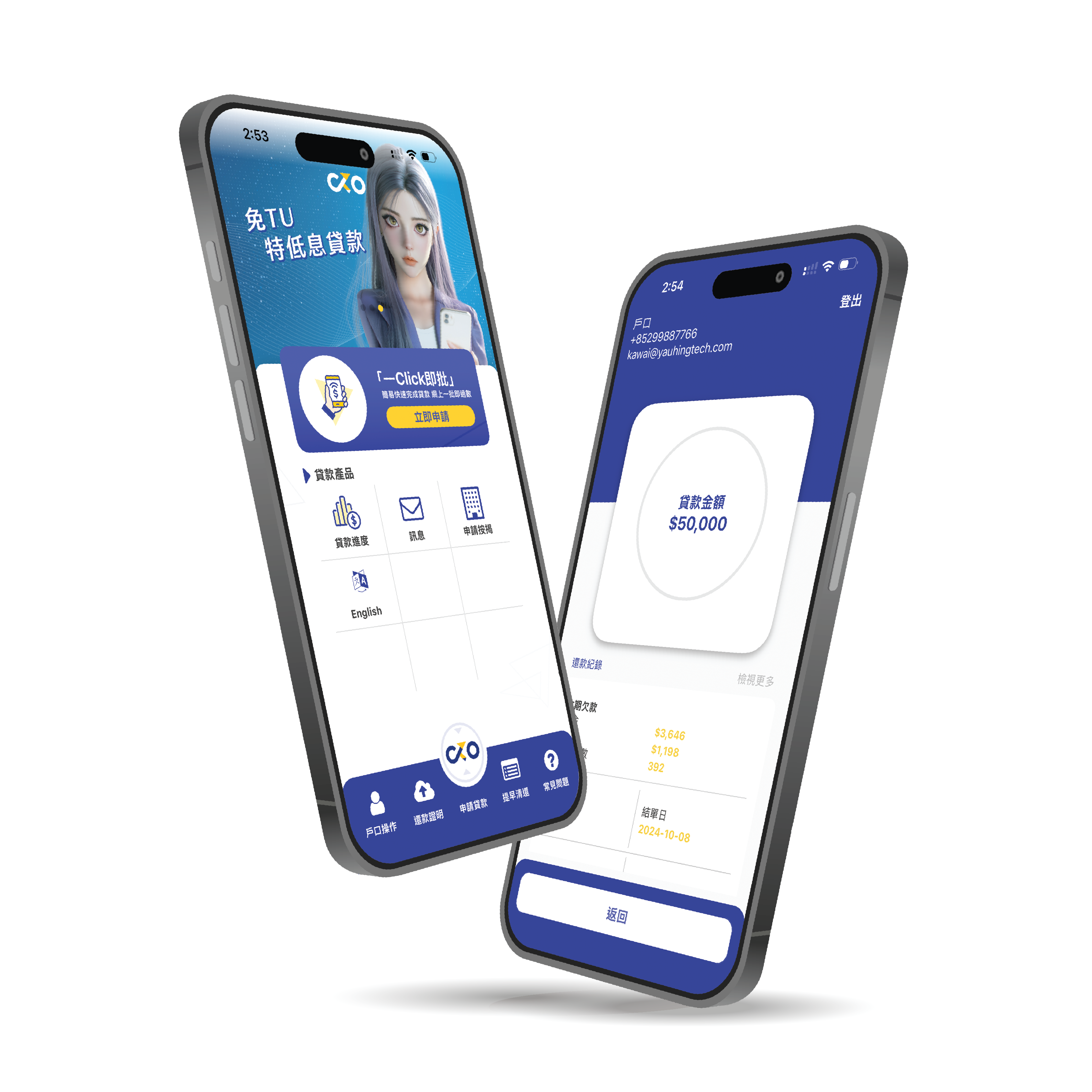

Empowering you to achieve your dreams

Fast Approval

Fast Cash 24/7

Credit KO understands life’s unpredictability. We offer fast and convenient online personal loans without face-to-face meetings or credit checks. Choose flexible repayment options.